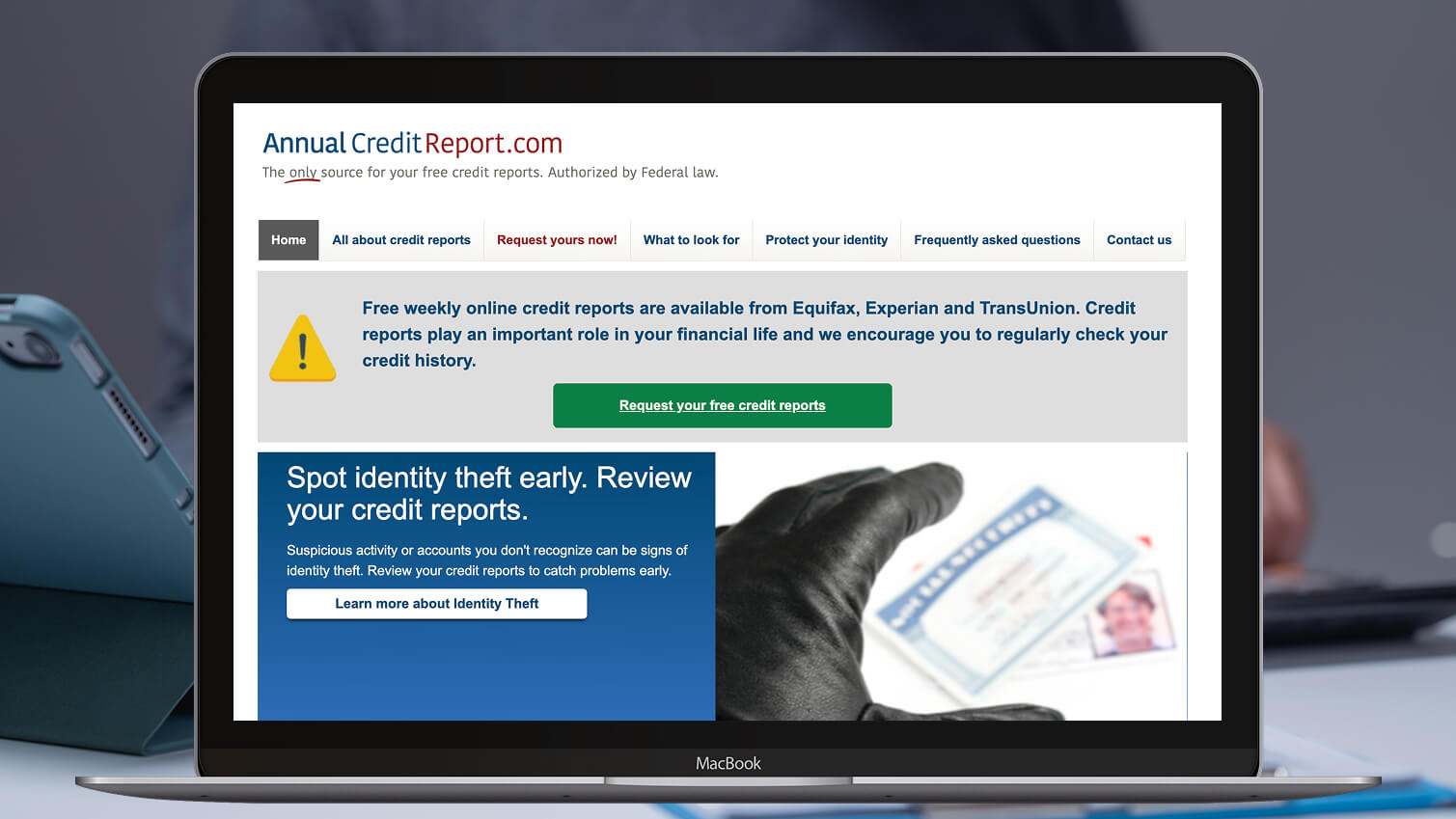

If you’ve ever searched for your credit report online, you may have come across AnnualCreditReport.com and wondered what it is. Like many consumers, you may even be a bit suspicious about why the site seems to have special access to your credit information.

No need to worry: AnnualCreditReport.com is the official, federally authorized website for accessing your credit reports directly from the three major credit bureaus at no cost.

What is ACR.com, and how can you use it to your advantage? Here’s everything you need to know.

What is AnnualCreditReport.com?

AnnualCreditReport.com is the only website authorized by federal law to provide free credit reports from Equifax, Experian, and TransUnion.

The site was created as a result of federal consumer-protection legislation and is jointly operated by the three bureaus. Its sole purpose is to give consumers direct access to their credit reports. The site doesn’t promote paid subscriptions or monitoring tools.

Since it isn’t a third-party service, AnnualCreditReport.com has privileges that other websites don’t. It's the official access point mandated by law.

What is FACTA?

The Fair and Accurate Credit Transactions Act (FACTA) is the law that requires credit bureaus to provide consumers with free access to their credit reports.

FACTA was passed to improve transparency and reduce the risk of identity theft. It also gives people more control over their financial data.

AnnualCreditReport.com exists to fulfill this requirement. Without FACTA, there wouldn’t be a single, centralized site where you could safely request a report from all three credit bureaus.

How can I access my credit report through ACR.com?

Now that you know that ACR.com is a legitimate website, it can be helpful to learn how to use it.

Run a quick Google search or type the site’s address directly into your address bar to pull up the homepage. Next, you’ll need to provide a few pieces of basic identifying information, such as your:

- Name

- Address

- Social Security number

- Date of birth

The site uses this information to verify your identity with the credit bureaus.

Once you’ve established your identity, you can choose to request reports from one, two, or all three of the bureaus at once. Each report may look slightly different and contain different information.

There are two schools of thought when it comes to requesting credit reports.

Some consumers like to review all three reports at the same time to look for discrepancies. Others may request one report every three or four months, since you’re entitled to a free report from each bureau every 12 months. This approach allows you to periodically check one of your reports throughout the rolling 12-month period.

After you’ve selected which reports you want to view, you’ll need to answer some identity-verification questions based on your credit history. You may encounter questions about your prior addresses, vehicles you’ve financed, and loan amounts.

Once you’ve passed the verification process, you can view and download your reports immediately.

Keep in mind that the site only provides credit reports, not scores. If you want to track your scores, you’ll need a separate monitoring solution.

Best apps for monitoring credit in 2026

If you’re interested in monitoring your credit throughout the year, take advantage of one of these top monitoring apps:

- Kikoff

- Experian

- Aura

- Credit Karma

- myFICO

Before choosing an app, consider whether you want just credit monitoring or additional perks as well.

For instance, Kikoff helps users add positive payment history to their credit profiles. It can provide valuable information to shed light on your credit report and build healthier habits over time. As a bonus, you don’t have to worry about hard credit checks.

Conclusion

AnnualCreditReport.com isn’t a gimmick or scam. It’s your source for accurate credit reports from the big three bureaus. Once you know what your report contains, you can focus on proactively improving your score and credit history by making wise financial decisions.

Ready to start building your credit? Use on-time payments to build credit with Kikoff.

.jpg)