AI is everywhere:,: powering the shows we stream, the routes we drive, and even the emails we write. But when it comes to money, most Americans are still missing out. Kikoff’s new survey of 1,500 consumers—most of whom are lower-income and actively working to build credit—shows a striking gap. The very group of people who could benefit most are also the least aware that AI tools exist to help them manage their finances.

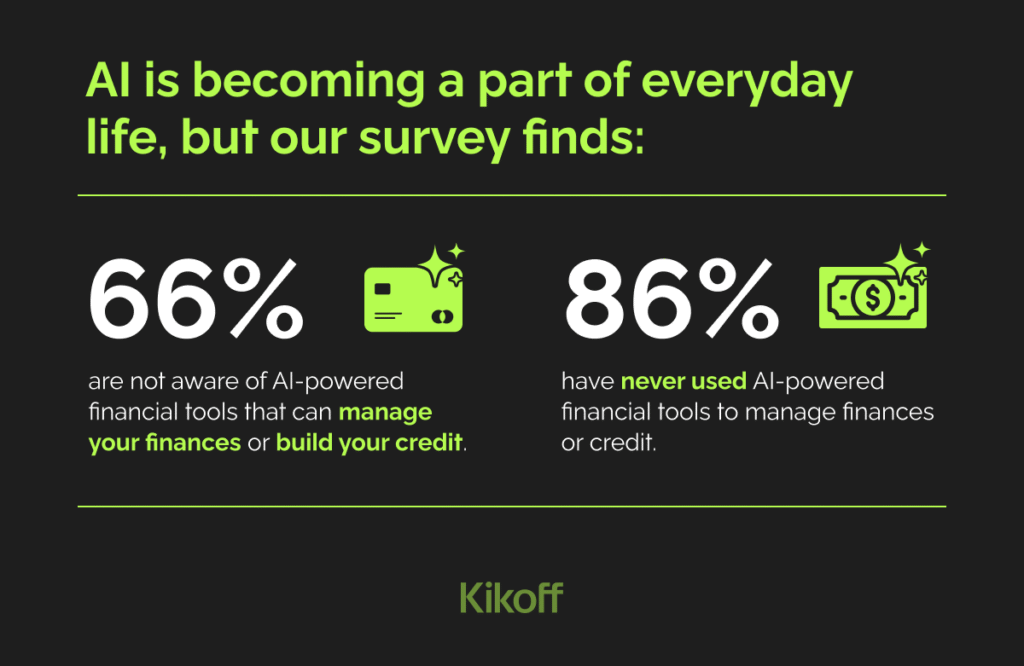

Awareness of AI in Finance and Credit Building is Still Low

AI is becoming part of daily life — according to an Associated Press-NORC survey, 60% of adults already use it to search for information and 40% use it for work. Yet Kikoff’s recent survey reveals most still haven’t connected it to their finances.

- 66% are not aware of AI-powered financial tools that can manage your finances or build your credit

;; - 86% have never used AI-powered financial tools to manage finances or credit.

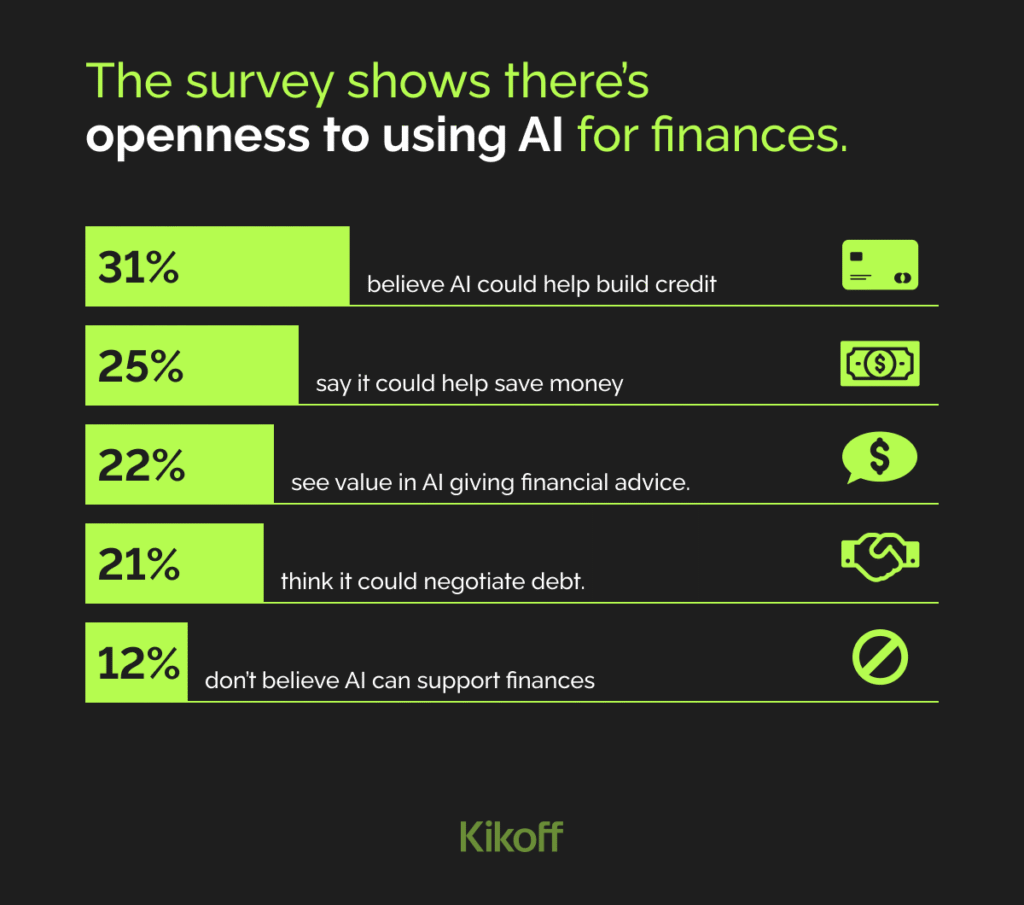

Still, there’s openness to the idea. When asked what they thought AI could help with financially today, some consumers said:

- 31% believes AI could build credit

- 25% believes AI could save money

- 22% give financial advice

- 21% negotiate debt

- Only 12% said they didn’t believe AI could help with building finances

..

Where Consumers Struggle and How AI Can Help

For consumers with subprime credit, education and cost remain the biggest hurdles. 23% said they don’t know where to start and 19% say it’s too expensive to build credit. These are exactly the kinds of challenges AI can help solve. With personalized, step-by-step guidance, AI can make the credit-building process less confusing. It can also bring down the cost of financial services, making them more affordable and accessible.

Cynthia Chen, Kikoff’s CEO, explains: “It’s exciting to see AI being used to improve people’s lives. Now we have the chance to bring that same power to consumers’ financial health, especially for those who have always faced barriers to entry. That’s where AI can be truly transformative.”

Survey Method:

This survey was conducted in August, 2025 via an online survey of 1,500 Kikoff users.