A good credit score opens doors. It shows lenders that you're trustworthy enough to repay loans. Here's what that gets you:

- Lower interest rates, so you can save thousands of dollars

- Insurance discounts

- Credit cards with the best rewards

- An easier time taking out loans - for your car, house, business, etc.

Our goal at Kikoff is to give you fair, effective, and simple pathways to help you meet your financial goals. Building your credit history should be easy...so that's why we made Kikoff.

How does the credit builder work?

Sign up for Kikoff

Find out instantly if you qualify for a Kikoff account. We don’t do a credit check, so signing up doesn’t negatively impact your score at all.

Build credit every month

We report your account to the major credit bureaus every month. By making on-time payments each month, you’ll be on your way to building your credit history. To help you be successful, we’ll send you payment reminders -- plus you have the option to turn on AutoPay and put your payments on autopilot.

Rinse and repeat for long term credit growth

Your Kikoff Credit Account does not expire, so you can use it for long-term credit growth. Remember, account age determines 15% of your credit score, so leaving it open for longer will help you continue to build your credit history.

How long will it take to show up on my credit report?

It depends! We report your payment to major credit bureaus Equifax, Experian, and TransUnion at the end of every month. It can take up to two weeks to be processed and added to your report. You can always keep track of your score on the Kikoff app.

How does Kikoff help me build credit?

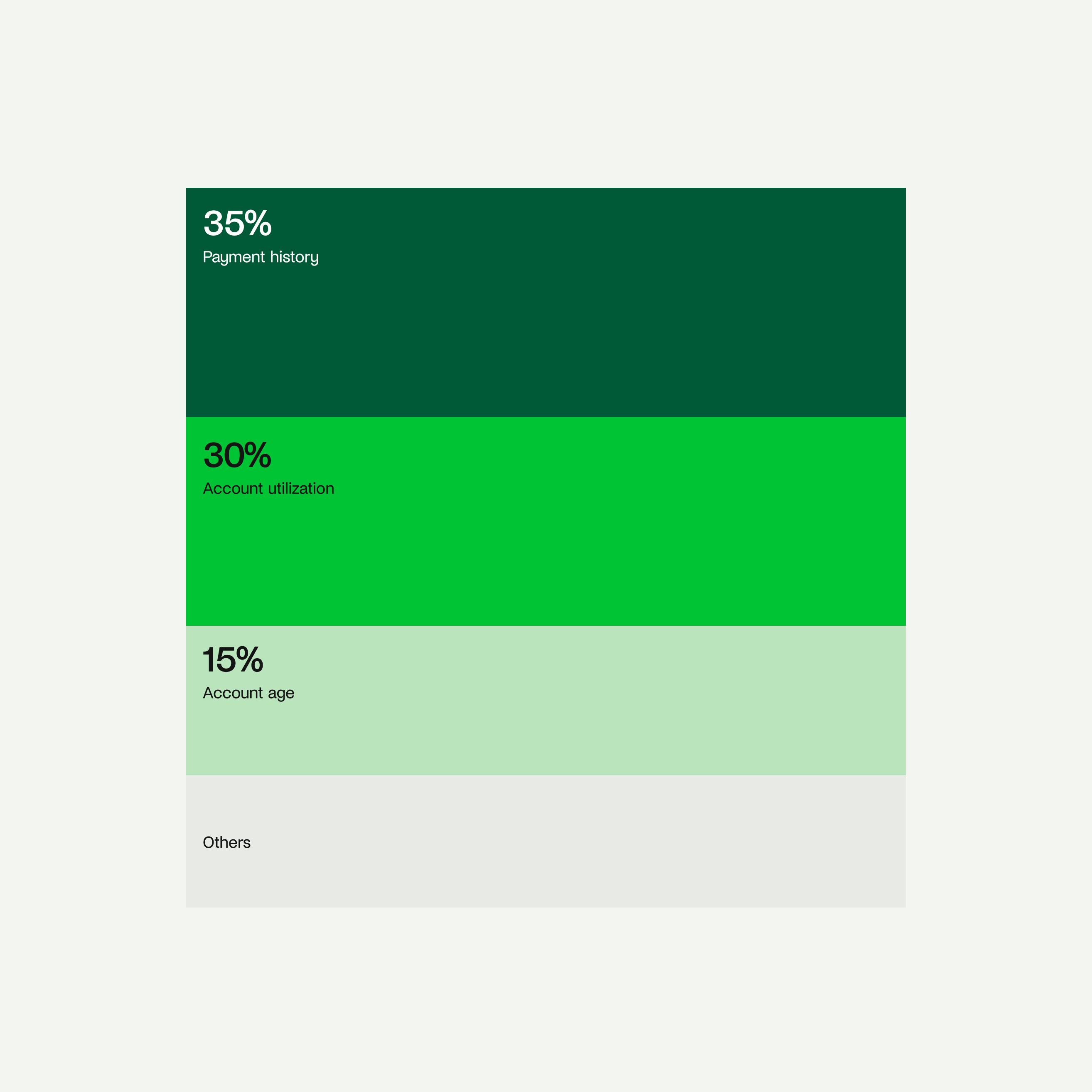

Our Credit Account addresses three key areas that affect your score: payment history, credit utilization, and average account age. Together, they make up 80% of your credit score.

Payment History

This looks at whether you’ve paid past bills on time. It’s the single most important factor in your credit score.

How Kikoff helps: We report each monthly payment you make to the major credit bureaus. Each one builds your payment history - and your credit.

Credit Utilization

This is the ratio of how much credit you’ve used to how much you can use - your credit limit. The lower this ratio, the better.

How Kikoff helps: The Credit Account is designed for extremely low utilization rates. We’re talking as less than 10%.

Account Age

The older your accounts, the better. Your Kikoff account doesn’t expire, so keeping it open will continue to increase the average age of your accounts.

When you initially join Kikoff, your account age might drop. This may even impact your credit. But remember that this drop is only short term! Starting a brand new account can bring your average age down. If you keep that account open, though, the average will go up even more than you started with. Opening a Credit Account gives you a long term positive with age.

Alright, I'm interested. But how is the Credit Account different from a credit card, or other credit builders?

Funny you asked . We’re different because we maximize credit growth. We encourage long payment history - seriously, once you open a Credit Account there is no expiration date.

We’re also one of the most affordable credit builders out there. We believe in transparency and accessibility. Kikoff has 0% interest and no hidden fees. There’s no credit check to apply, and no deposit necessary. Here’s how we stack up among competitors:

More questions? Check out our FAQ. Nerdwallet also breaks down the Kikoff Credit Account in this review (that we did not pay them to write ).