New Kikoff surveys reveals the growing impact of inflation, tariffs, and financial stress.

Inflation and economic uncertainty continue to reshape how people manage their money. And now, with tariffs poised to drive prices even higher, financial stress is climbing.

Kikoff conducted two surveys—one on inflationary pressure, the other following news of upcoming tariffs—to understand how these shifts are impacting consumer behavior. In both surveys, over 1,000 Kikoff users were polled, primarily individuals actively working to build or rebuild their credit. 79% said their financial stress has increased since the news of tariffs broke. More than half (51%) expect their costs to rise by 26–50% in the months ahead.

So how are people coping? They’re cutting back, borrowing more, and doing whatever they can to get by.

Essentials are becoming harder to afford.

While economic policies keep changing, the cost of everyday life keeps climbing, and for many, even the necessities are out of reach.

- 86% of people say inflation has made it more difficult to afford basics like gas, groceries, and other everyday needs.

- More than one (36%) in three worry every day about being able to pay for essentials like food, housing, or transportation.

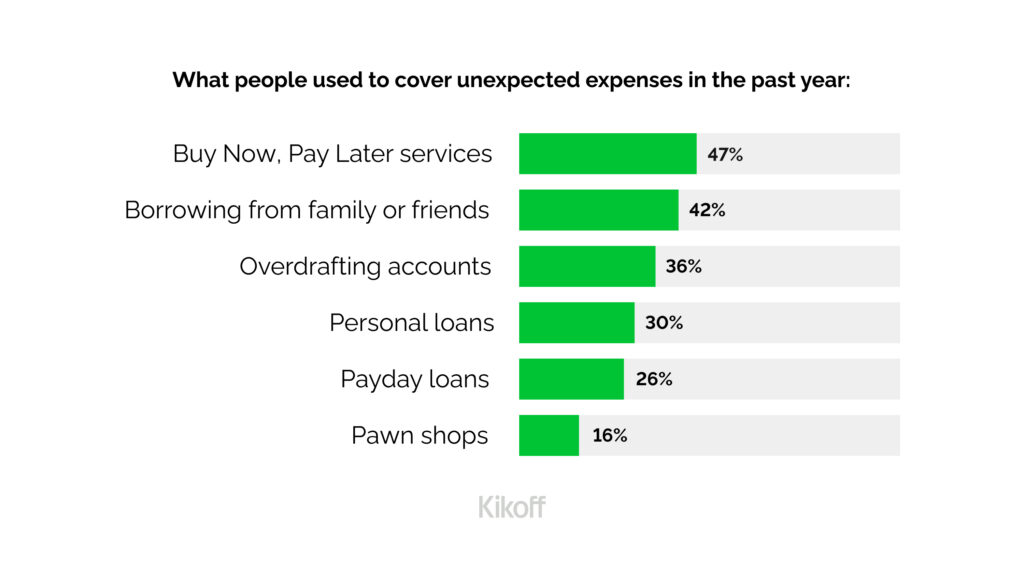

Debt is becoming a lifeline.

Credit card debt reached a new high at the end of 2024, exceeding $1.2 trillion. That shows no sign of slowing with 44% of respondents planning on turning to credit cards as debt continues to rise with tariffs.

Others are turning to Buy Now, Pay Later (BNPL) services as a more flexible way to manage unexpected expenses. Though recent rule changes will begin reporting BNPL services to credit bureaus, usage is high, with 47% of respondents using BNPL to bridge financial gaps.

That’s not the only fallback. People are also turning to:

- Friends and family for personal loans (42%)

- Bank overdrafts (36%) and personal loans (30%)

- Higher-risk options like payday loans (28%) and pawn shops (16%)

It was recently reported that the average American does not have $1,000 saved in the event of a surprise expense, which exposes a deeper issue: many Americans lack a financial safety net and they’re tapping every available resource to stay afloat.

Summer is getting scaled back.

This year, 73% of people say they’re cutting back on summer spending. That means canceling trips, skipping summer camps, and taking on more of the childcare burden themselves. For families trying to enjoy a break, rising costs are making it harder to justify the expense.

Among those who had travel plans, 53% say they’re adjusting due to the tariffs — shortening trips, cutting back on activities, or canceling altogether.

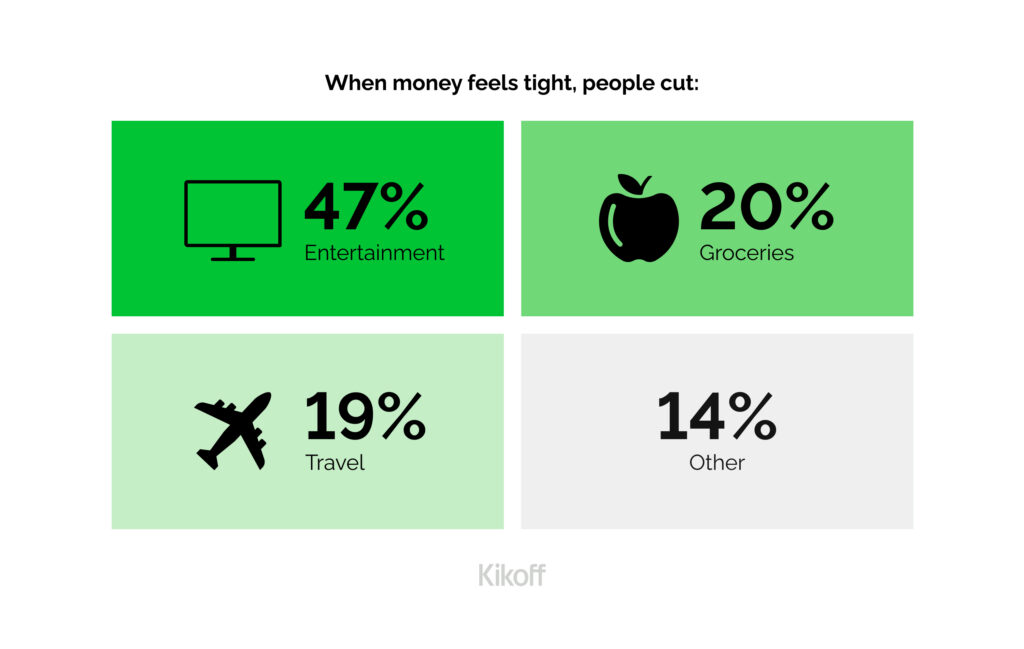

Even those staying close to home, are making tradeoffs:

- 47% are cutting entertainment

- 20% are cutting back on groceries

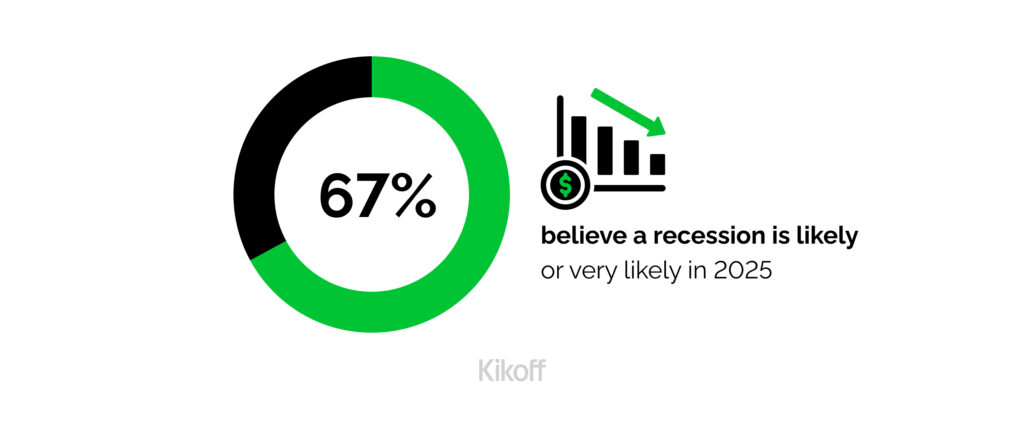

People are bracing for what’s next.

With rising costs and few signs of relief, people are not just reacting, they’re preparing.

- 64% rate the U.S. economy as “poor” or “very poor”

- 67% believe a recession is likely in 2025

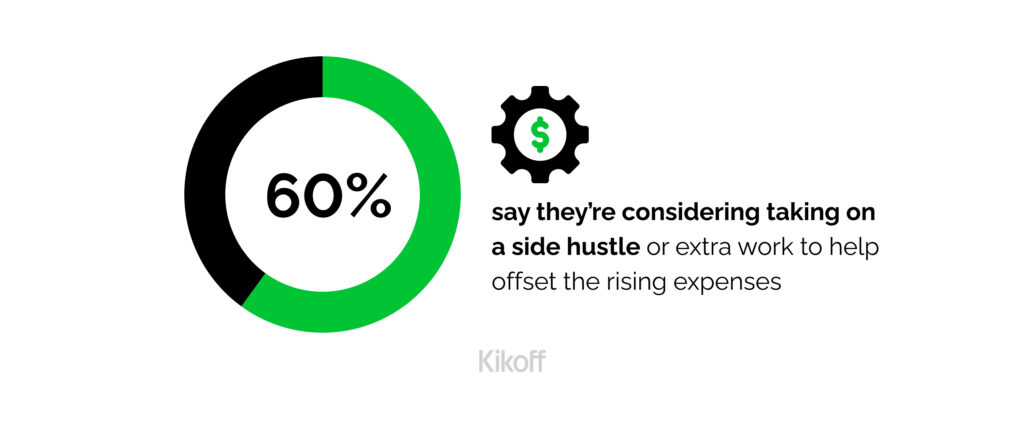

51% expect tariffs to raise their personal costs by 26–50%

As a result, people are looking beyond cost-cutting and toward earning more. 60% say they’re considering taking on a side hustle or extra work to help offset the rising expenses.

What this means.

The data shows that Americans are feeling the pressure, but they’re taking action: adapting, cutting back, and finding ways to stay ahead as costs continue to rise.

At Kikoff, we’re building creative, low-cost financial solutions to help people navigate what’s ahead. In a time of economic uncertainty, short-term fixes might not be enough, we are providing tools to plan ahead and take control. From building credit to saving money through AI Debt Negotiation and Dispute services, our goal is to help people move forward with confidence.

Need Help Building Your Credit?

Explore our Credit Builder program to take control of your financial health.

Survey 1 was conducted by Kikoff in March 2025 via an online survey of 1,700 Kikoff users.

Survey 2 was conducted by Kikoff in April 2025 via an online survey of 1,000 Kikoff users.